How much will you save on your Home Loan now that Interest rates are at a record low?

What’s Changed?

Recently the Reserve Bank of Australia cut the rate to a record low interest rates of 1.25%. The 4 big banks have passed this on in some capacity. CBA and NAB the full 0.25 drop, Westpac 0.20 and ANZ 0.18.

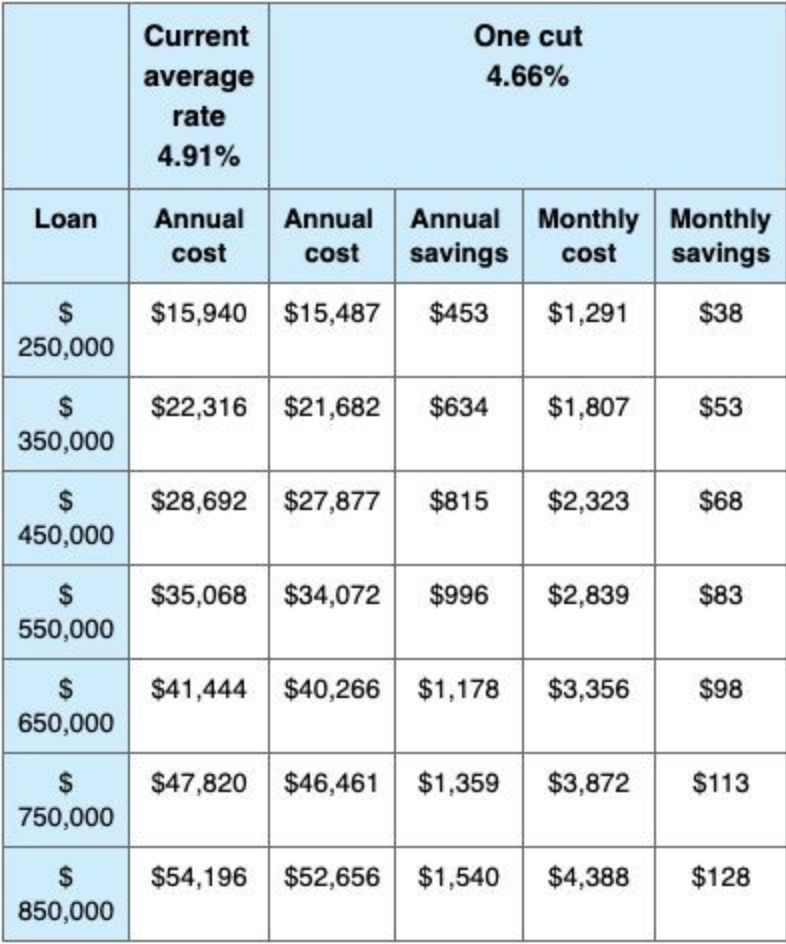

So, how much will this save you on your mortgage?

Well depending on how much you owe you could be saving between hundreds to thousands per year. On average, a 0.25% drop on a $400,000 home loan would be a saving of around $700 per year (based on Principal and interest over 30 year term)

Another way of benefiting from the rate cut is refinancing your existing home loan or investment property. It could be that products have changed since you first committed. Your lender may not be offering the best rate anymore and you could be paying too much.

Reasons you may consider re-financing your Home loan or Investment Property:

Get a Lower Interest Rate:

Fixed rate period on your current loan is expiring and is changing back to a higher variable rate

Cash Out on the Equity:

Your property has increased in value and you would like to use the equity to cash out for renovations or use towards purchase of an investment property

Lower Repayments:

You may want to reduce your repayments by moving to a lower interest rate or changing loan products

Pay off your loan quicker:

You can afford to pay off the loan faster and want to re-finance to reduce the term

Consolidate other debts:

You want to consolidate other debts such as car-loans, credit cards or personal loans.

What can we do to help?

At SB Finance we can assist with refinancing your Home loan and help you find a loan that suits your situation. We offer an obligation free service and will ensure we are professional and responsive.

Refinancing doesn’t have to be with your same lender. We have access to over 35 of Australia’s biggest lender and can help you find the right loan for your needs and circumstances.

Speak to our team of experts to see if refinancing your home loan can be beneficial for you as re-financing a home loan can sometimes have costs associated. For more information, speak to one of our team and see if we can offer a free home-loan health check.

Contact Us

Disclaimer – SB Finance (aust) Pty Ltd (trading as SB Finance ABN: 72 620 392 038) provides factual information, general advice and services on financial products as a Licensed credit representative (499191) of Larrijade Pty Ltd t/as Drive Finance Australian credit license 393048.We can also provide you with general advice and factual information on a range of other products, services and providers. We hope that the information and general advice we can provide will help you make a more informed decision. We are not owned by any Bank or Insurer and we are not a product issuer or a credit provider. Although we cover a wide range of products, providers and services we don’t cover every product, provider or service available in the market so there may be other options available to you. We also don’t recommend specific products, services or providers. If you decide to apply for a product or service through our website you will be dealing directly with the provider of that product or service and not with us. We endeavour to ensure that the information on this site is current and accurate but you should confirm any information with the product or service provider and read the information they can provide. If you are unsure you should get independent advice before you apply for any product or commit to any plan. (c) 2018.